Return on Investment (ROI)

A measure of the profitability of an investment, calculated as the percentage of return relative to the initial investment. For example, if you’ve invested $100 and your investment is now worth $150, your ROI is 50% (i.e. 50% of the original sum invested).

What Is Return on Investment (ROI)?

ROI is a measure used to evaluate the profitability of an investment relative to its cost. It is expressed as a percentage and helps investors determine how much profit or loss they have made on an investment.

How It Works

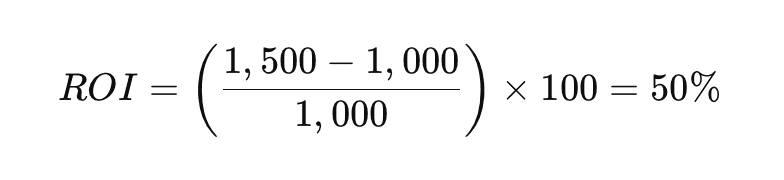

- Formula: ROI is calculated by subtracting the initial investment amount from the final value of the investment, then dividing that result by the initial investment amount and multiplying by 100 to get a percentage.

- Positive ROI: A positive ROI indicates a profitable investment, meaning the final value is higher than the initial cost.

- Negative ROI: A negative ROI means the investment resulted in a loss, with the final value being less than the original cost.

Example

If you invested $1,000 in a stock, and after one year, the value of that investment grows to $1,500, your ROI would be:

This means you made a 50% return on your initial investment (half of $1,000, or $500).

The Sum Up

In short, ROI is a simple way to measure how much money you've made (or lost) on an investment relative to how much you spent.

Other terms in this Category.