Crypto Wallets vs Bank Accounts: What’s the Difference and Which Should You Use?

As cryptocurrencies become more mainstream, many people are asking a very modern financial question: Should I store money in a crypto wallet or a traditional bank account?

What is the concise response? It depends on what you're trying to do. Here’s a side-by-side look at crypto wallets vs bank accounts, including safety, access, flexibility, and risk.

What Is a Crypto Wallet?

A crypto wallet is a digital tool that stores your cryptographic keys the codes that allow you to access and manage your cryptocurrencies, such as Bitcoin or Ethereum.

There are two main types:

- Hot wallets are digital wallets that are connected to the internet, such as MetaMask, Trust Wallet, and Coinbase Wallet.

- Cold wallets: Offline devices like hardware wallets (e.g., Ledger, Trezor), which are considered more secure for long-term storage.

Unlike a bank, you own and control your funds directly with a crypto wallet. But with great power comes enormous responsibility; if you lose your keys, there’s no "forgot password" button.

What Is a Bank Account?

A bank account is a custodial financial service provided by a regulated institution. The bank holds your money and provides you with access through cards, mobile apps, or branch visits.

Bank accounts:

- Offer FDIC or FSCS insurance on balances.

- Your identity and government regulations are associated with these factors.

- Provide interest, overdrafts, and credit lines.

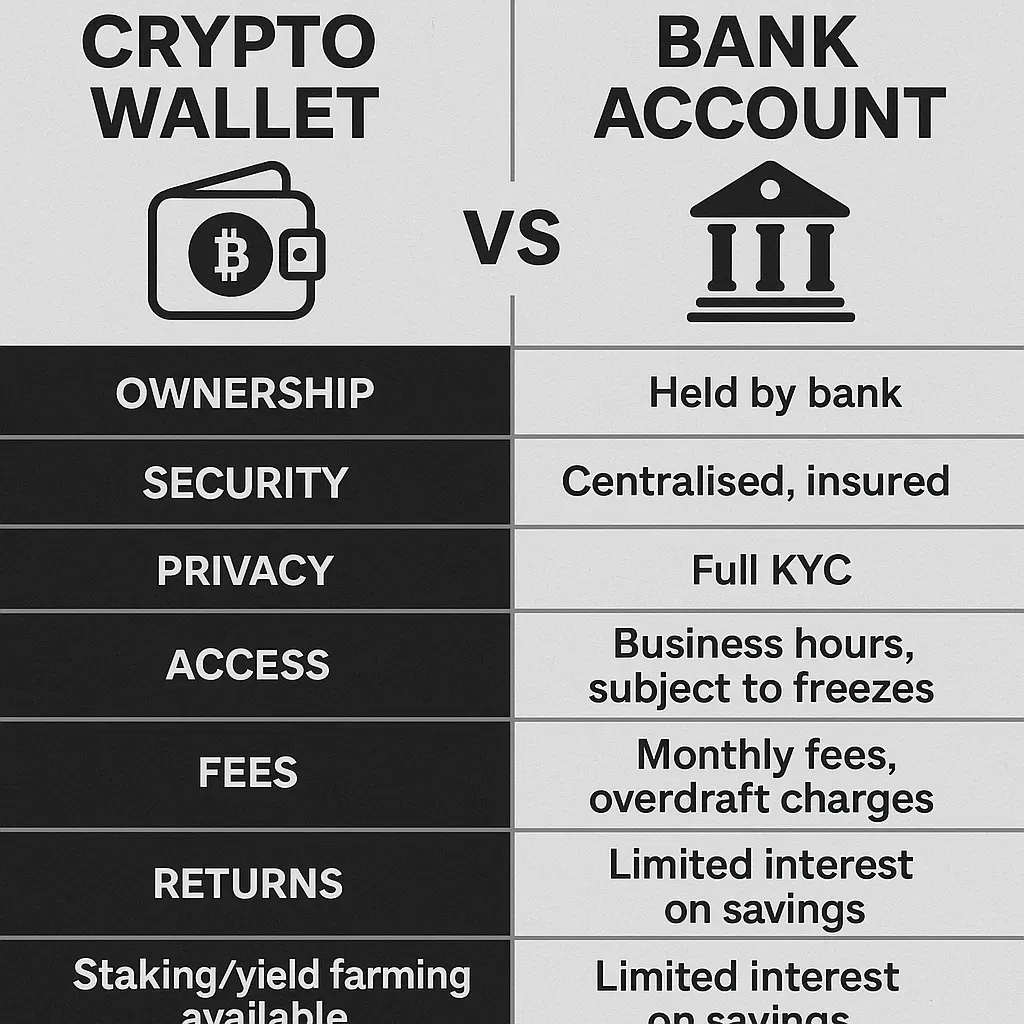

Key Differences: Crypto Wallets vs Bank Accounts

| Feature | Crypto Wallet | Bank Account |

|---|---|---|

| Ownership | Full control | Held by bank |

| Security | Decentralised, risk of loss/theft | Centralised, insured |

| Privacy | Pseudonymous | Full KYC (Know Your Customer) |

| Access | 24/7, no intermediaries | Business hours, subject to freezes |

| Fees | Network fees only | Monthly fees, overdraft charges |

| Returns | Staking/yield farming available | Limited interest on savings |

Which Should You Use?

- Feel free to use a bank account if you wish:

- Day-to-day spending

- Salary deposits

- Government-insured safety

- Access to loans and credit

- Use a crypto wallet if you like:

- Full control over digital assets

- Exposure to decentralised finance (DeFi)

- Censorship resistance

- Cross-border payments with low fees

Some savvy users opt for both keeping their fiat in banks for stability and holding crypto in wallets for investment or international flexibility.

The Bottom Line

Crypto wallets and bank accounts serve different purposes. One offers security and access to the traditional financial system; the other provides freedom and direct control in the world of digital assets.

As the worlds of finance and crypto continue to merge, understanding both is key to managing money in 2025 and beyond.

Stay on top of any cryptocurrency news by following us on X @ouinex