Crypto Flash Crash Hits Bitcoin and Ethereum

Global markets were rattled this morning after a crypto flash crash sent shockwaves across the industry, wiping billions from the value of digital assets in just a few hours. Bitcoin, Ethereum and XRP all fell sharply as investors scrambled to make sense of the sudden decline.

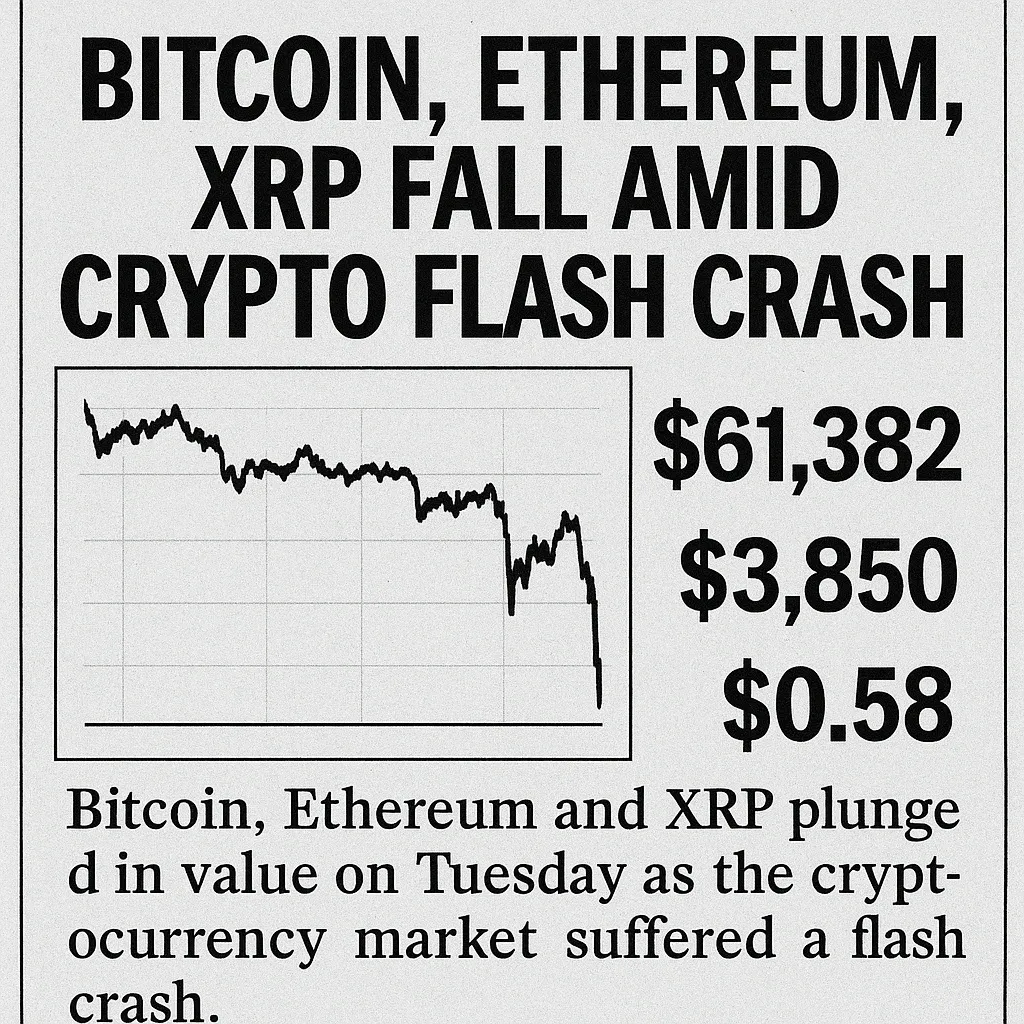

Bitcoin, the largest cryptocurrency by market value, dropped almost 3 percent to trade around 111,382 dollars. Ethereum lost close to 3 percent to trade near 3,850 dollars, while XRP slipped more than 2.5 percent to 0.58 dollars. The declines followed a week of optimism driven by dovish comments from the US Federal Reserve, which had pushed traders into risk assets.

The culprit, analysts say, was a large sell order from a crypto whale. The liquidation triggered a cascade of automated trades across exchanges, leaving retail traders exposed. A crypto flash crash is not unusual in such a market, but the scale of this event revived fears about stability in digital assets.

"This sell-off highlights the structural weaknesses in how crypto markets handle liquidity," one London-based analyst explained. "When whales move, they cause shockwaves. The crypto flash crash showed again that overleveraged traders are vulnerable to cascading losses."

The impact extended beyond tokens. Coinbase shares fell more than 2 percent in premarket trading. Strategy Inc, the largest corporate holder of Bitcoin, saw its stock decline over 4 percent. The correlation between cryptocurrencies and equity markets continues to strengthen, raising questions about systemic risk.

Still, seasoned investors were quick to highlight the opportunity. Historically, Bitcoin has rebounded strongly after sudden declines. "Every crypto flash crash is both a risk and an opportunity," said a veteran trader in Frankfurt. "Retail often sells into panic, while institutions quietly add to their positions."

Ethereum’s fundamentals remain strong, with ongoing demand from decentralised finance projects and increasing momentum around tokenisation of assets. XRP also continues to find niche demand in cross-border payments, particularly in emerging markets. This suggests that while volatility will persist, underlying adoption continues to grow.

The episode is also a reminder of the risks in leveraged trading. Retail investors chasing short-term gains are often the first casualties in a crypto flash crash. Regulators have long warned that crypto remains a high-risk asset class, but enthusiasm has not diminished.

Looking ahead, macroeconomic conditions will continue to dictate sentiment. Inflation figures in the US, interest rate expectations, and global geopolitical tensions will all play a role in whether the market regains momentum. Yet few doubt that volatility is here to stay.

For now, traders must treat the crypto flash crash not as an anomaly but as part of the DNA of the sector. Managing exposure, avoiding excessive leverage, and keeping a long-term perspective remain the only proven ways to navigate such storms.

Stay on top of any cryptocurrency news by following us on X @ouinex