Best Platforms to Stake USDC

With savings account interest rates lagging behind inflation, many crypto users are turning to stablecoin staking particularly with USDC, the dollar-pegged stablecoin issued by Circle. In 2025, staking USDC offers yields between 4% and 12% APR, with flexible terms and increasing institutional-grade security.

But which is the best platform to stake USDC safely and profitably? Here's a breakdown of the top options from DeFi protocols to CeFi platforms based on yield, reputation, and risk.

1. Ouinex Earn – Best for Regulated Yield with Instant Access

- APY: 6–10%

- Ouinex stands out because it offers real-time earnings in USDC without requiring any lockups. Ouinex holds funds in audited DeFi pools and provides access through a centralised, KYC-compliant interface.

- Perfect for: Users who want yield with accountability, no rug pulls.

- Bonus: Withdraw at any time with no penalties. The system seamlessly integrates with trading accounts.

2. Aave (on Polygon or Base) – Best for On-Chain Lending Yield

- APY: 4–7%

- Why it stands out: Aave is one of the most secure DeFi protocols, with billions in TVL and multiple audits. You lend your USDC to other users and earn interest, all via smart contracts.

- Perfect for: DeFi-savvy users who want self-custody and transparency.

- Bonus: Supports hardware wallets and low gas fees on Layer 2 chains.

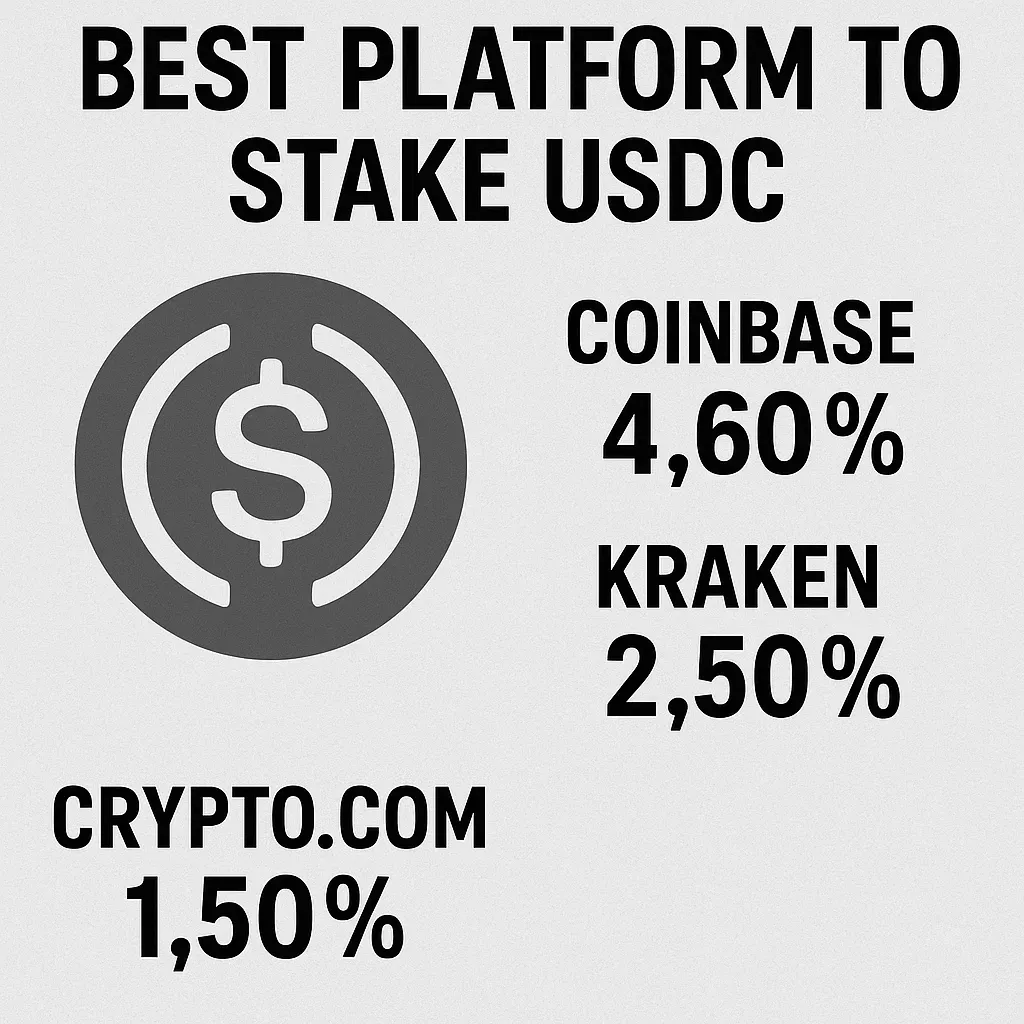

3. Coinbase USDC Vault – Best for Beginners

- APY: 4–5%

- Why it stands out: As Circle’s founding partner, Coinbase offers direct access to USDC savings accounts with insured custody. Yields are lower, but security and simplicity are unmatched.

- Perfect for: First-time crypto users or conservative investors.

- Bonus: Regulated under US law, no smart contract risk.

4. Yearn Finance (v3) – Best for Yield Optimization

- APY: 7–11% (dynamic)

- Why it stands out: Yearn seamlessly distributes your USDC among various lending and staking pools to optimise yield, all without requiring your intervention.

- Perfect for: Yield farmers and passive income enthusiasts.

- Note: There is a slightly higher risk profile because of the complexity of the smart contract.

5. Crypto.com Earn – Best for Flexible Terms on a Mobile App

- APY: 4–8%

- It stands out due to its popular mobile interface, fixed and flexible staking options, and the ability to boost rewards using CRO tokens.

- Perfect for: Mobile-first users and travellers.

- Bonus: Offers optional lock-up periods for higher yield.

⚠️ Risks to Consider

- Smart contract vulnerabilities (DeFi platforms)

- Withdrawal limits or delays (CeFi)

- Stablecoin depegging (though USDC has a strong track record)

- Regulatory uncertainty in some jurisdictions

Stay on top of any cryptocurrency news by following us on X @ouinex