The BIG Back-to-School Morning Mood: Everything to Start Right ☀

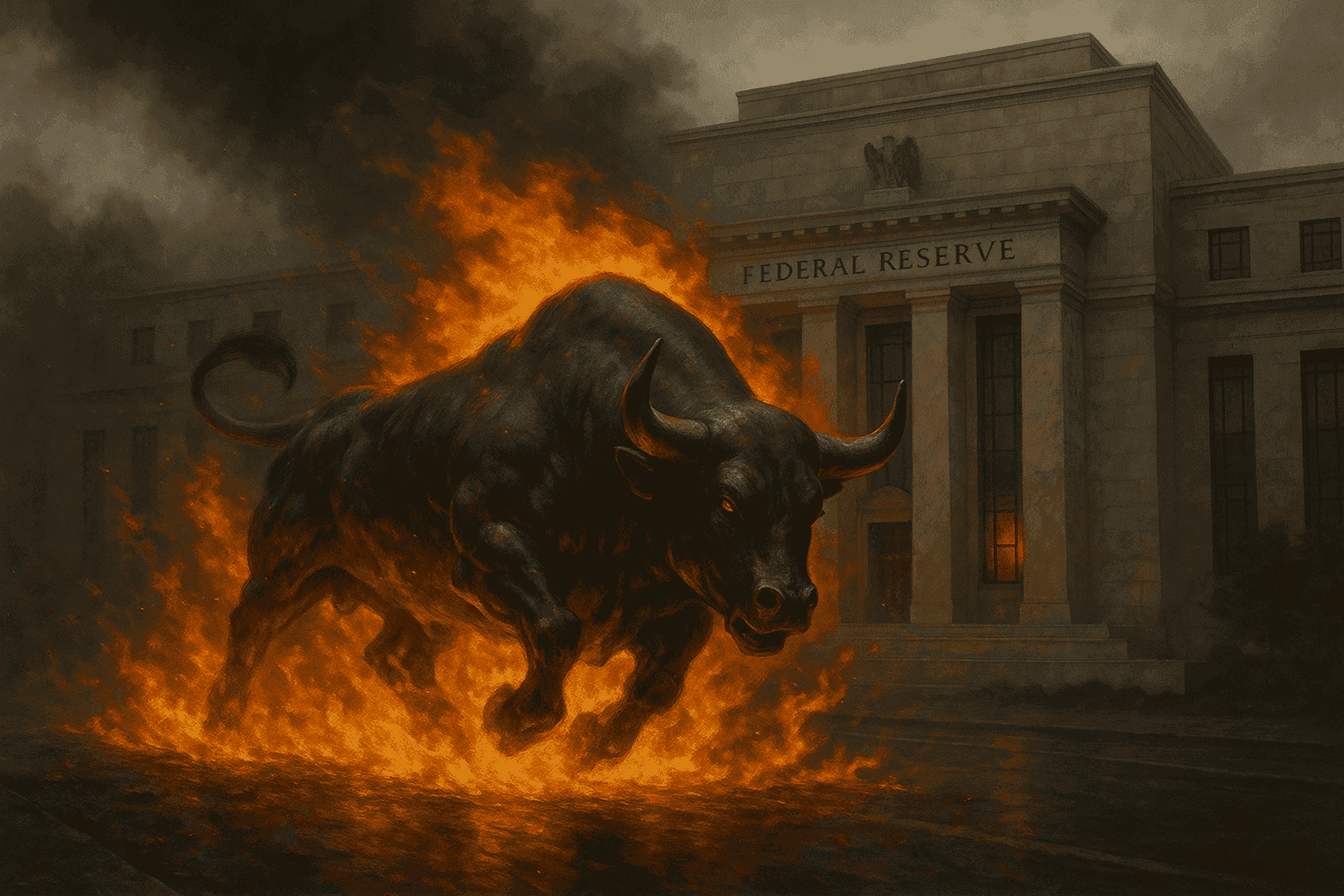

September 1, 2025 marks a no-nonsense return. Financial markets jump straight into the action, skipping the warm-up. It's 7 a.m., and the atmosphere is already intense. US jobs, interest rates, inflation… everything is at stake this week. And clearly, there’s no room for improvisation this fall.

The US jobs report (NFP), due this Friday, will be decisive. It's the last major indicator before the Fed meeting on September 16 and 17. Today, most investors expect two rate cuts by year-end, maybe three. The problem is, this is already priced in. If job numbers are too good, the Fed might decide to do nothing. And markets aren’t ready for that.

Meanwhile, inflation remains stuck at around 2.7%, which doesn’t argue for a more accommodating monetary policy either. We're entering a tense waiting phase, where every report can tip the market one way or the other.

On the European side, the contrast is glaring. While US indices remain high, the DAX has been stuck in a narrow range since May. The CAC 40, meanwhile, struggles to regain upside momentum. Europe seems more fragile, especially as political uncertainty grows in France, with a shaky confidence vote adding to the instability. French 10-year yields are rising again, putting more pressure on the country’s massive debt.

In this context, gold is bouncing back. The $3,280 level was a support over summer, and prices are now nearing $3,500. The uptrend remains, as long as the precious metal doesn’t return to its previous range. Silver follows suit, with more volatility. This Monday morning, it climbs 2%, while gold is up just under 1%.

On the stock market, caution is key. There's no clear buy signal on the CAC as long as it stays above 7,700. Maybe an opportunity arises around 7,200 or even 6,800, but only if a real technical signal appears. US indices keep riding their trend, powered by tech and AI. But beware: don't confuse excitement for real strength. AI is everywhere, but it’s not yet delivering tangible returns to justify such high valuations.

As for crypto, same story: stagnation. Bitcoin remains weak, while Ether, Solana, AVE, or Hyperliquid maintain better momentum. We’re in a sideways phase, like late 2024, with several failed bullish breakouts. The strategy stays the same: lighten up near the top, buy back lower. For now, the nets are out, waiting for better times.

But beyond the markets, early September is also a time to refocus on your own goals. It’s not just about a trading plan, but a life plan. Prioritize, structure your days, find balance between performance and well-being. Set your own rules. Like running a half-marathon calmly, just for fun. Like keeping a journal, noting what goes well, what’s blocking you, and what you want to improve.

That morning, the pleasure of ticking off important tasks without pressure, making progress on all fronts—work, personal, family—gives a sense of control. That’s the real return. Telling yourself that, in a 24-hour day, you’ve had the upper hand. Not over everything, of course. But over what matters.

And above all, remember that it’s not the events that define us, but how we respond. Maybe that’s the most valuable lesson of this 2025 back-to-school season.