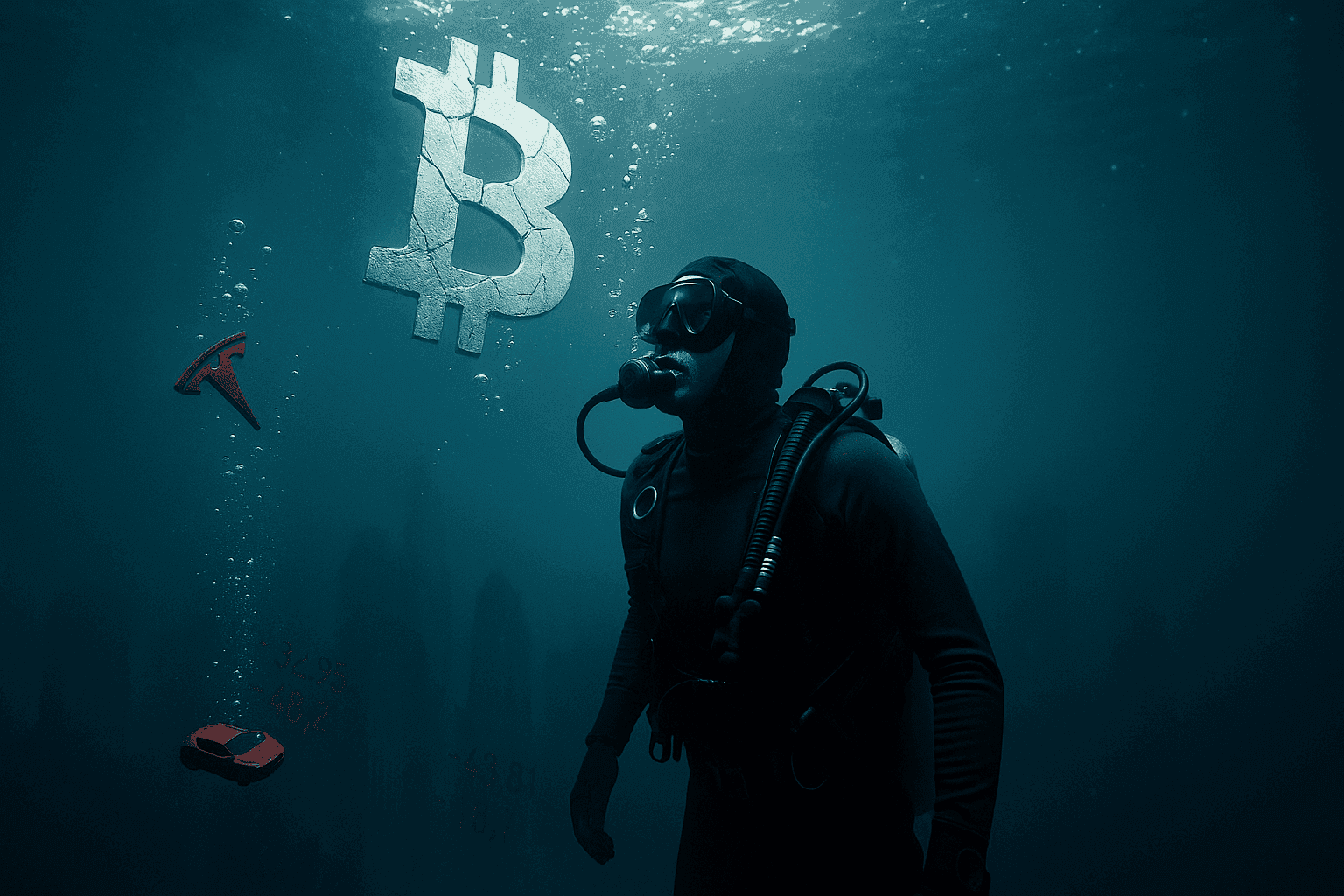

BITCOIN under pressure, Tesla slumps, markets gasping: Serious or not?

A pivotal summer for investors

Friday, July 25 starts on a note of consolidation in the cryptocurrency market. This breather, expected after the recent euphoria, is not a threat but an opportunity for those who know how to remain clear-headed and strategic. In traditional markets, momentum remains broadly positive, with American indices still driven by technology and innovation, while Europe evolves in more uncertain territory.

Crypto consolidation phase: Understand and act

The pullback seen on Solana, Bitcoin, and other major cryptocurrencies is a natural market movement. After the frenzy, correction phases help to cleanse the trend, eliminate excess leverage, and provide new entry points for disciplined investors. For now, daily trends remain upward and active management—buying on pullbacks and quickly securing positions—remains the most relevant strategy.

Stock indices: America leads, Europe waits

In the United States, the SP500, Nasdaq, and Dow Jones are hitting or nearing all-time highs. Positive momentum persists, especially while key supports hold. In Europe, the picture is more neutral: the CAC40 and DAX are moving within identified ranges, encouraging the targeting of extremes and patience. The important thing is to act methodically, without being unsettled by the noise of the market.

Corporate earnings: Nuances and opportunities

Earnings season brings mixed reactions. Tesla lost 8% after mixed results but remains within its long-term range. Alphabet posted solid figures but the market reacted cautiously. Alstom stood out with a 13% surge in a week. For investors, these moves are a reminder of the importance of active management, gradual trimming, and adapting to cycles.

Macroeconomy and anticipation: Stay alert

PMI statistics, largely in line with expectations, signal a market seeking direction. This week is calm, but the next will be decisive with PCE, US GDP, job creation (NFP), and the Fed. Be ready to seize opportunities while maintaining discipline and perspective when making decisions.

Psychology and managing uncertainty: Stay in control

In a volatile environment, self-control remains a decisive asset. Gradual management, buying on dips, securing gains quickly, or being patient when there's no signal—these are the best tools for weathering consolidation phases. Investors who favor rational analysis and thoughtful action outperform those who follow euphoria or collective panic.

Crypto trading focus: Method and discipline

For Bitcoin and Ethereum, sideways phases mean focusing on buying at supports and actively managing positions. Solana, bought on a technical zone and secured quickly, illustrates a proactive approach suited to today’s environment.

Civic engagement and environmental vigilance

Beyond finance, a local incident reminds us all of our role in society: the discovery of abandoned food waste in nature highlights the need for vigilance and responsibility, to protect the environment and act for the common good.

Conclusion: Clarity, discipline, and optimism for the future

The current consolidation is not a threat, but a healthy stage on the road to performance. Investors who remain clear-headed, disciplined, and open to opportunities will be the big winners in the coming months. The key is to move forward, trust yourself, and act methodically—both in markets and in life.

Strength, honor, eyes on the future.