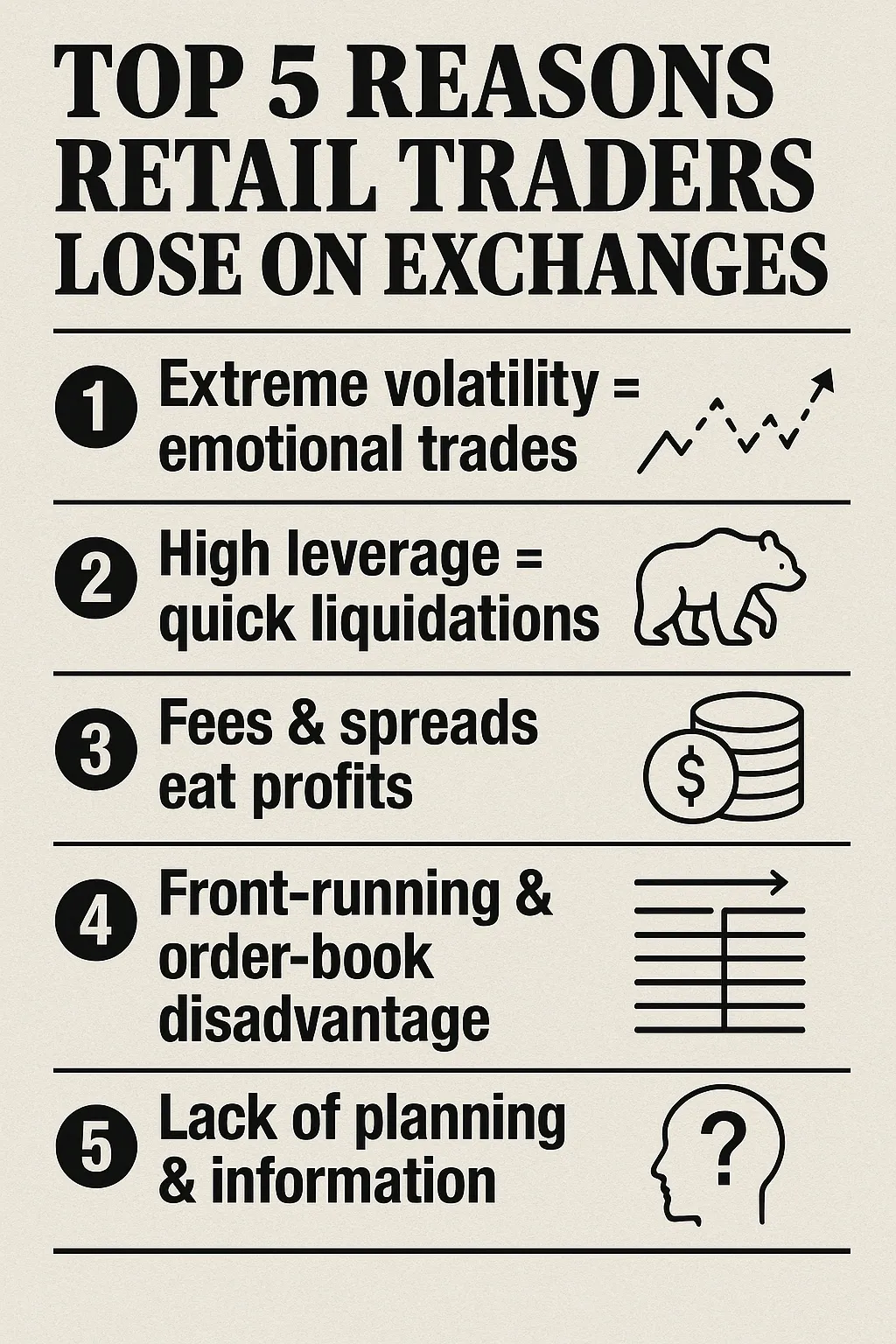

Why Retail Traders Lose on Crypto Exchanges

It’s the same story repeated across forums and late‑night Telegram chats: the small investor who jumped into crypto full of hope, only to watch their capital evaporate. In a market worth more than $4 trillion, the majority of retail traders still lose money. The reasons are not mystical; they are structural, psychological, and, in some cases, baked into how crypto exchanges operate.

Volatility That Punishes the Unprepared

Cryptocurrency operates continuously. Due to 24-hour trading and the absence of safety measures, prices can fluctuate significantly within minutes. A token rising 10% at breakfast can plunge 15% by dinner. For retail traders with little experience, that volatility is brutal. They buy in a frenzy as prices peak and sell in panic at the first sign of a drop. Institutions hedge and wait. Retail investors act impulsively.

Leverage: The Silent Account Killer

Many exchanges lure customers with 50x or even 100x leverage with the promise of life‑changing returns from tiny positions. In reality, it’s a liquidation trap. A move of less than 1% against a leveraged position can wipe out the entire account. Professional trading desks thrive on that churn; retail traders end up feeding the machine.

Fees and Spreads Eat Away Profits

It’s not just incorrect timing that erodes a small trader’s account. Trading fees on some platforms reach 0.2% per transaction, and illiquid markets often feature spreads wide enough to put a position in the red the moment it’s opened. For high‑frequency institutional players, these costs are negligible. For retail, they add up fast.

Order‑Book Advantage and Front‑Running

Retail traders presume that all participants on an exchange adhere to the same set of rules. They don’t. Exchanges and market makers with superior data can anticipate large retail orders and move prices just before they execute a practice known as front‑running. It means the everyday trader often pays more than the chart suggests, while sophisticated players collect the difference.

Psychology: FOMO and Fear

Even without hidden fees or complex algorithms, human nature is enough to sink many portfolios. Retail traders often follow hype on social media, chasing so‑called “moonshots” instead of sticking to a clear strategy. Fear of missing out drives them into rallies late; fear of bigger losses forces them out in despair. The market rewards discipline, not emotion.

The Knowledge Gap

Institutions spend millions on research, order flow analytics and proprietary signals. The average retail trader relies on rumours, YouTube influencers or Discord groups. That information gap translates directly into weaker decision‑making and, ultimately, losses.

Can Retail Traders Win?

Yes, but it requires a mindset shift. Avoid extreme leverage. Focus on liquid markets. Use limit orders to control entry and exit. Build and follow a strategy rather than chasing the crowd.

What is the harsh reality? Crypto exchanges are designed to generate volume, not to guarantee your success. Until retail traders approach markets with professional discipline, the system will continue to tilt in favour of those who already know how to win.

Stay on top of any cryptocurrency news by following us on X @ouinex