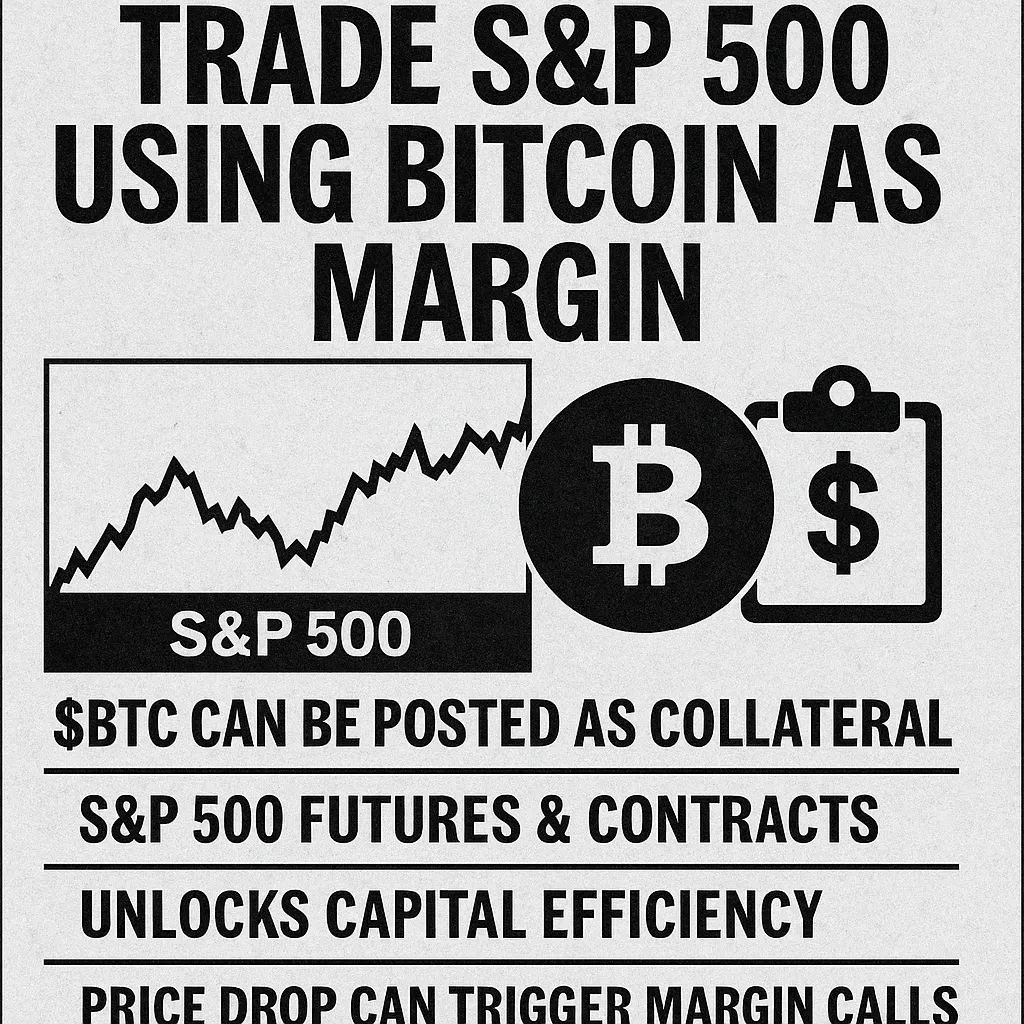

Trade S&P 500 Using Bitcoin as Margin: A New Frontier for Investors

Traditional finance and digital assets are merging more rapidly than before. In a development that would have seemed unthinkable a few years ago, traders can now use Bitcoin as margin collateral to trade S&P 500 futures and contracts on select global platforms.

A Hybrid Approach to Margin

Traditionally, brokers have required margin to be posted in cash or stable collateral like US Treasury bills. But with Bitcoin’s rise to over $118,000 and growing adoption by regulated exchanges, several venues now accept the cryptocurrency as margin to back positions in equity indices such as the S&P 500.

“It’s about unlocking trapped capital,” said Marcus Hill, head of derivatives at a London‑based brokerage. “If you’re long Bitcoin and don’t want to sell, you can deploy that position to finance trades in highly liquid instruments like the S&P 500.”

Where It’s Happening

A growing roster of exchanges particularly in Singapore, Dubai, and Switzerland has integrated crypto custody with traditional futures clearing. Platforms like Deribit Institutional and CME‑linked custodial partners are offering accounts where a Bitcoin balance can be used to post margin, while the underlying trades remain regulated S&P 500 contracts.

This structure allows traders to keep exposure to Bitcoin while diversifying into equity index strategies, including hedging portfolios or speculating on US stock‑market volatility.

Advantages for Active Traders

For professional and high‑net‑worth clients, the benefits are clear:

- Capital Efficiency: Instead of converting Bitcoin to dollars, traders can collateralise it directly.

- Hedging Flexibility: A trader holding large Bitcoin positions can short S&P 500 futures as a hedge without liquidating digital assets.

- 24/7 Portfolio Management: Some platforms sync crypto and equity margin in near‑real time, providing continuous risk management.

Risks and Considerations

Of course, using Bitcoin as collateral introduces unique risks. A sudden drop in Bitcoin’s value can trigger margin calls far faster than with stable collateral. Exchanges typically apply higher “haircuts,” valuing Bitcoin at a discount to account for volatility.

“Traders need to monitor both legs of their exposure,” warned Sarah Greene, a derivatives lawyer in London. “If Bitcoin swings 10% in an hour, your S&P 500 position could face an immediate margin shortfall.”

A Glimpse of the Future

The ability to trade blue‑chip indices like the S&P 500 using Bitcoin as margin marks a milestone in market convergence. It reflects growing comfort among institutions with crypto collateral and a demand for more flexible cross‑asset strategies.

For investors, it’s another sign that Bitcoin is evolving from a speculative token into a functional piece of the global financial system. And as more platforms roll out similar features, the once‑separate worlds of Wall Street and blockchain are drawing ever closer together.

Stay on top of any cryptocurrency news by following us on X @ouinex