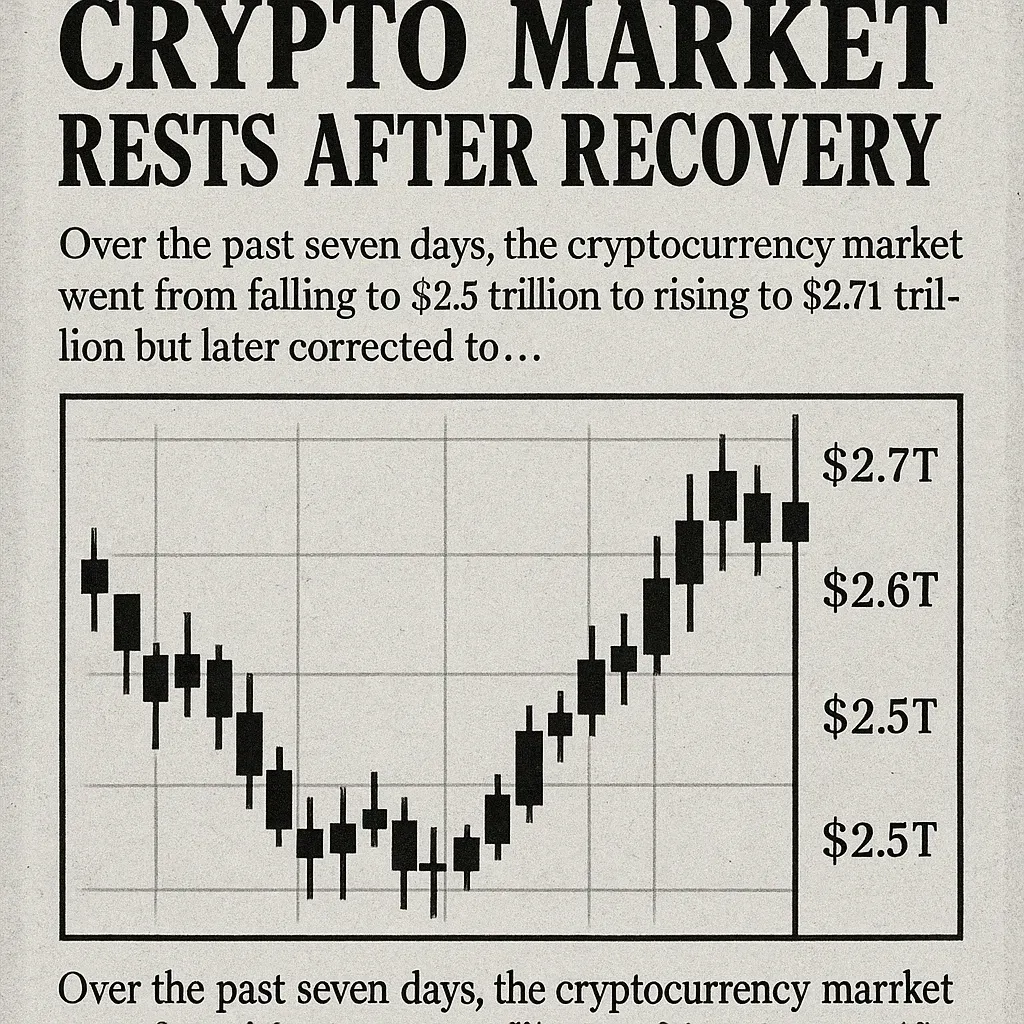

Crypto Market Rests After Recovery Rally Pushes Capitalisation to $2.71 Trillion

After a week of volatile swings and brief euphoria, the global cryptocurrency market is catching its breath, settling just above $2.65 trillion following a short-lived rally that pushed total capitalisation to $2.71 trillion before a midweek correction.

The market had previously dipped to around $2.5 trillion, prompting fears of a broader risk-off shift. But a quick turnaround led by Bitcoin and Ethereum helped restore investor sentiment before sideways trading returned by the weekend.

Bitcoin Holds, Ethereum Slips

Bitcoin (BTC) remains the dominant force in the recovery, holding steady at around $83,200 and maintaining support above the critical $82,000 level. The asset had briefly touched $84,600 during Thursday’s Asia session, but profit-taking and macroeconomic jitters capped further gains.

Ethereum (ETH), meanwhile, has struggled to keep up the pace, falling below the $3,200 level after touching a weekly high of $3,350. Analysts point to a drop in DeFi volumes and increased competition from Layer 2s and rival chains like Solana and Base as factors behind ETH’s relative underperformance.

“Ethereum is losing short-term momentum, but its fundamentals remain intact,” said Clara Roth, market strategist at Onchain Metrics. “We may see consolidation here as traders rotate capital into higher-beta assets.”

Altcoins in Pause Mode

Top altcoins also saw cooling price action, with Solana (SOL) down 3% on the week, Cardano (ADA) flat, and Avalanche (AVAX) slipping slightly after a short-lived rally. Meme coins, which had enjoyed a resurgence earlier in the month, also pulled back, with DOGE and SHIB shedding gains amid fading hype.

Despite the broader pause, select sectors continued to outperform. AI-linked tokens and real-world asset (RWA) protocols saw steady inflows, while decentralised infrastructure projects like RenderNet (RNDR) and Celestia (TIA) posted moderate gains.

A Period of Market Reset

Experts say the cooling-off period was both necessary and expected after weeks of rapid growth. With multiple ETF approvals, regulatory softening in the U.S., and growing institutional inflows, the market may be entering a phase of “healthy recalibration”.

“We’re seeing a natural digestion phase after a strong rally,” said Marcus Kim, head of research at Seoul-based CryptoIQ. “The long-term trend remains bullish, especially as macroeconomic uncertainty starts to stabilise and capital continues to rotate into the sector.”

On-chain data confirms the narrative, with exchange outflows for Bitcoin reaching a monthly high and derivatives funding rates returning to neutral after flashing signs of overheating.

Eyes on the Fed and ETFs

Ahead, traders anticipate that upcoming U.S. inflation data and Federal Reserve commentary will impact short-term volatility. Traders are also watching for inflows into spot Bitcoin and Ethereum ETFs in the U.S. and Europe, considered a key barometer of institutional appetite.

For the time being, it's evident that cryptocurrency is not collapsing, but rather regaining its momentum.