Crypto Market Pulls Back as Bitcoin Dominance Climbs and Altcoins Retreat

The crypto market finally slowed down after weeks of exuberant rallies. Bitcoin dominance – the share of the total crypto market held by Bitcoin – climbed back above 61% on Wednesday, signalling a rotation out of speculative altcoins and back into the perceived safety of the world’s largest digital asset.

Altcoins Lead the Slide

Recent high‑flyers such as ENA, TON and Arbitrum (ARB) bore the brunt of the sell‑off, dropping sharply in early trading. Solana (SOL) and XRP also slipped through key support levels, with both tokens falling more than 5% in 24 hours.

Across the market, over $500 million in leveraged long positions were liquidated, wiping out traders who had been chasing further upside. The pullback comes after a month‑long run that had pushed many altcoins to multi‑month highs.

Markets do not rise linearly, according to Daniel Lin, a crypto strategist based in Singapore. “The rise in Bitcoin dominance indicates that capital is consolidating in the most liquid asset, which often occurs before volatility spikes again.”

Ethereum Dips – But Fundamentals Remain Strong

Even Ethereum wasn’t spared, retreating to around $3,600 amid the wider market softness. However, in the background, the second-largest blockchain seems to be laying a strong foundation for its upcoming move.

Spot Ethereum ETFs – which launched earlier this year – continue to see heavy inflows. According to data providers, more than $500 million flowed into ETH ETFs on Tuesday alone, bringing total net inflows since mid‑May to nearly $10 billion.

On‑chain metrics support the bullish backdrop. Analysts highlight that institutional treasuries and staking services are accumulating ETH at a pace outstripping new supply by almost 7‑to‑1, a dynamic that historically precedes sustained rallies.

Sentiment Still in “Greed”

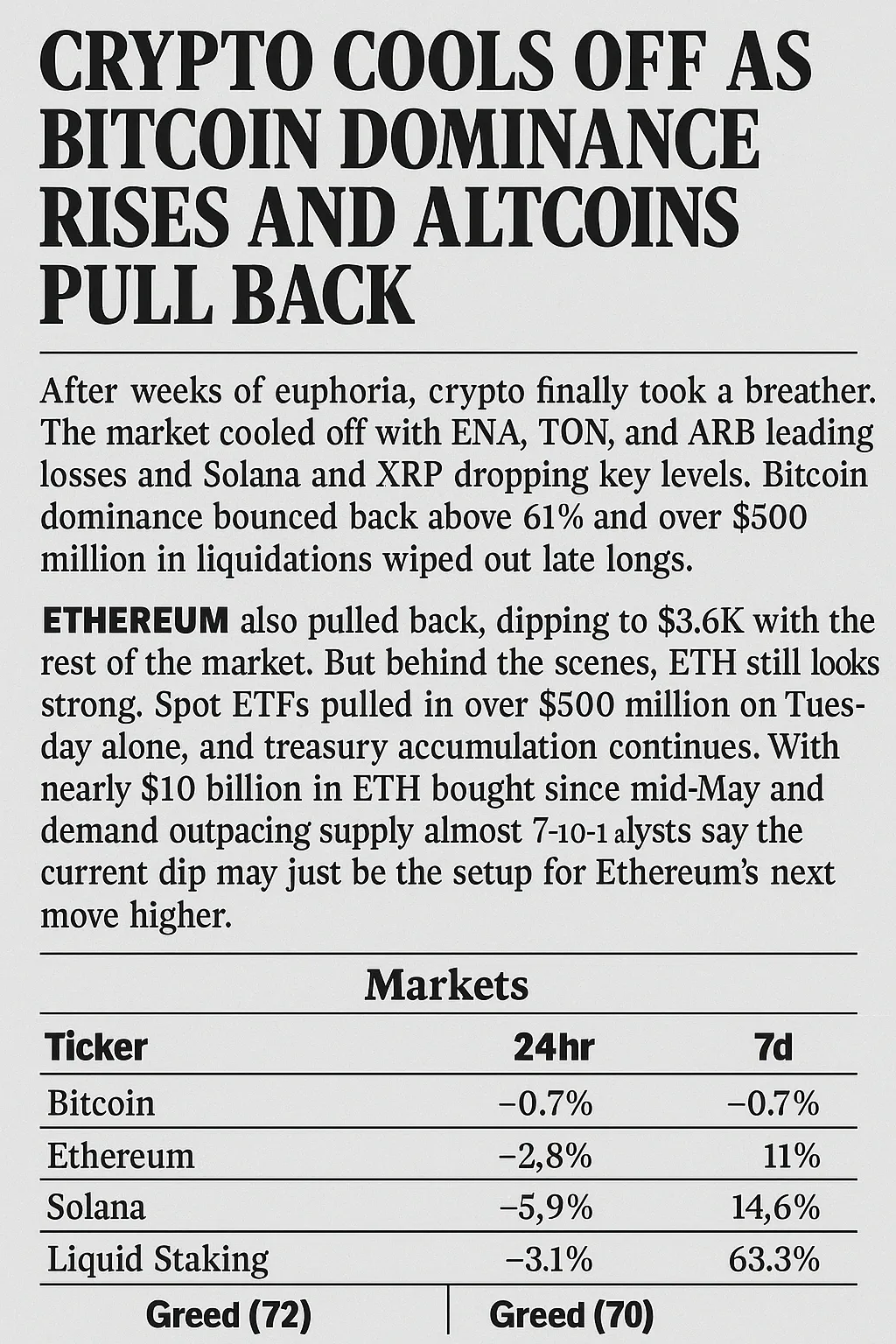

Despite the pullback, the Fear & Greed Index remains in Greed territory at 72, only slightly down from 74 earlier in the week. That suggests traders see the dip as a breather rather than a trend reversal.

Bitcoin’s modest decline of 0.7% on the day and 0.6% over seven days contrasts with sharper losses elsewhere, reinforcing its role as a market anchor. Ethereum’s 11% gain over the past week, despite the dip, shows bullish sentiment hasn’t vanished.

What’s Next?

For now, analysts expect a period of consolidation. Bitcoin dominance near 61% often signals that altcoins may need to cool before mounting another run. Many traders are watching Ethereum closely for signs of renewed momentum, particularly given the supply‑demand imbalance and steady ETF inflows.

“This is the pause that refreshes,” Lin added. “If fundamentals hold, Ethereum could be setting up for another leg higher but for now, patience is key.”

Stay on top of any cryptocurrency news by following us on X @ouinex