Best Crypto Exchanges for Real Execution

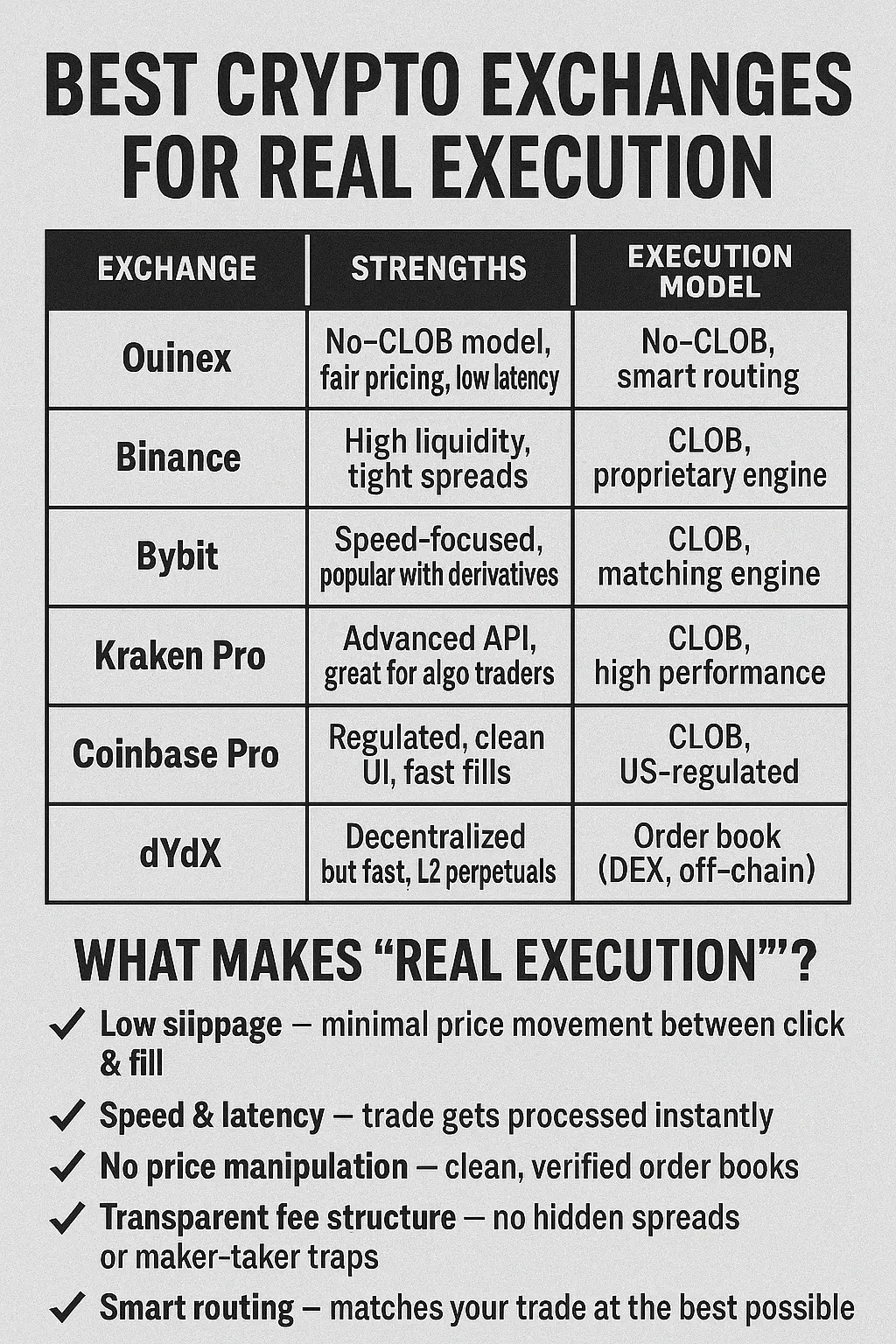

In the world of cryptocurrency trading, execution is everything. It’s the difference between a successful trade and a costly miss. In 2025, with markets moving faster than ever, traders are seeking platforms that offer real execution, not manipulated order books, inflated spreads, or artificial delays.

Whether you’re a retail trader or an institutional player, here’s a breakdown of the best crypto exchanges for real execution, based on speed, transparency, order matching, and slippage control.

1. Ouinex – Best for Fairness and Direct Execution

- Model: No-CLOB (No Central Limit Order Book)

- Why it stands out: Unlike most exchanges that rely on a CLOB model (which can favour market makers or bots), Ouinex uses direct routing and smart execution algorithms to ensure trades reflect true market conditions not internalised pricing.

- Ideal for: Traders tired of hidden spreads and manipulation.

- Bonus: Lower latency, transparency, and no fees for passive execution.

“It’s the first time I’ve traded on a platform that feels like I’m not fighting the system,” says one professional trader based in Lagos.

2. Kraken – Best for Spot Execution in the US & EU

- Model: Centralised order book, tightly regulated

- Why it stands out: Kraken is one of the few exchanges that consistently provides accurate order book depth, low slippage, and reliable API performance.

- Ideal for: Institutions and high-volume traders in regulated regions.

- Bonus: Proof-of-reserves and consistent uptime.

3. Binance – Best for Liquidity and Speed

- Model: CLOB + internal liquidity pools

- Why it stands out: Binance’s vast liquidity ensures tight spreads and quick order fills but it's important to watch for internalisation of trades that may not always reflect external market movements.

- Ideal for: Day traders and scalpers who need speed and volume.

- Caution: Limited regulatory clarity in some regions.

4. Bybit – Best for Derivatives Execution

- Model: Matching engine optimised for perpetual futures

- Why it stands out: Low latency, high throughput, and consistently tight spreads on perpetual pairs.

- Ideal for: Leverage traders and derivatives specialists.

- Note: Offers both USDT- and coin-margined futures.

5. Coinbase Advanced – Best for Retail Transparency

- Model: CLOB with direct access for verified users

- Why it stands out: Combines solid UI/UX with execution quality you can audit. Trades are matched without hidden markups, and retail orders aren’t routed to dark pools.

- Ideal for: Regulated users, especially in the US and UK.

What to Look for in Real Execution

- Order transparency: Can you see your place in the book?

- Slippage control: Are orders filled near your limit price?

- Latency: How fast do orders execute?

- Fees vs fills: Are you being front-run or price-shifted?

Stay on top of any cryptocurrency news by following us on X @ouinex