CoinDCX Hack: $44m Lost but India’s Crypto Market Stays Resilient

India’s largest crypto exchange, CoinDCX, has confirmed a security breach that drained an operational wallet but insists customer funds remain safe. Industry insiders, however, believe the scale of the theft could be as high as $44 million. The episode, quickly dubbed The Pink Panther Hack on social media, has reignited concern over operational security in the world’s fastest-growing crypto market.

A Breach With Echoes of WazirX and ByBit

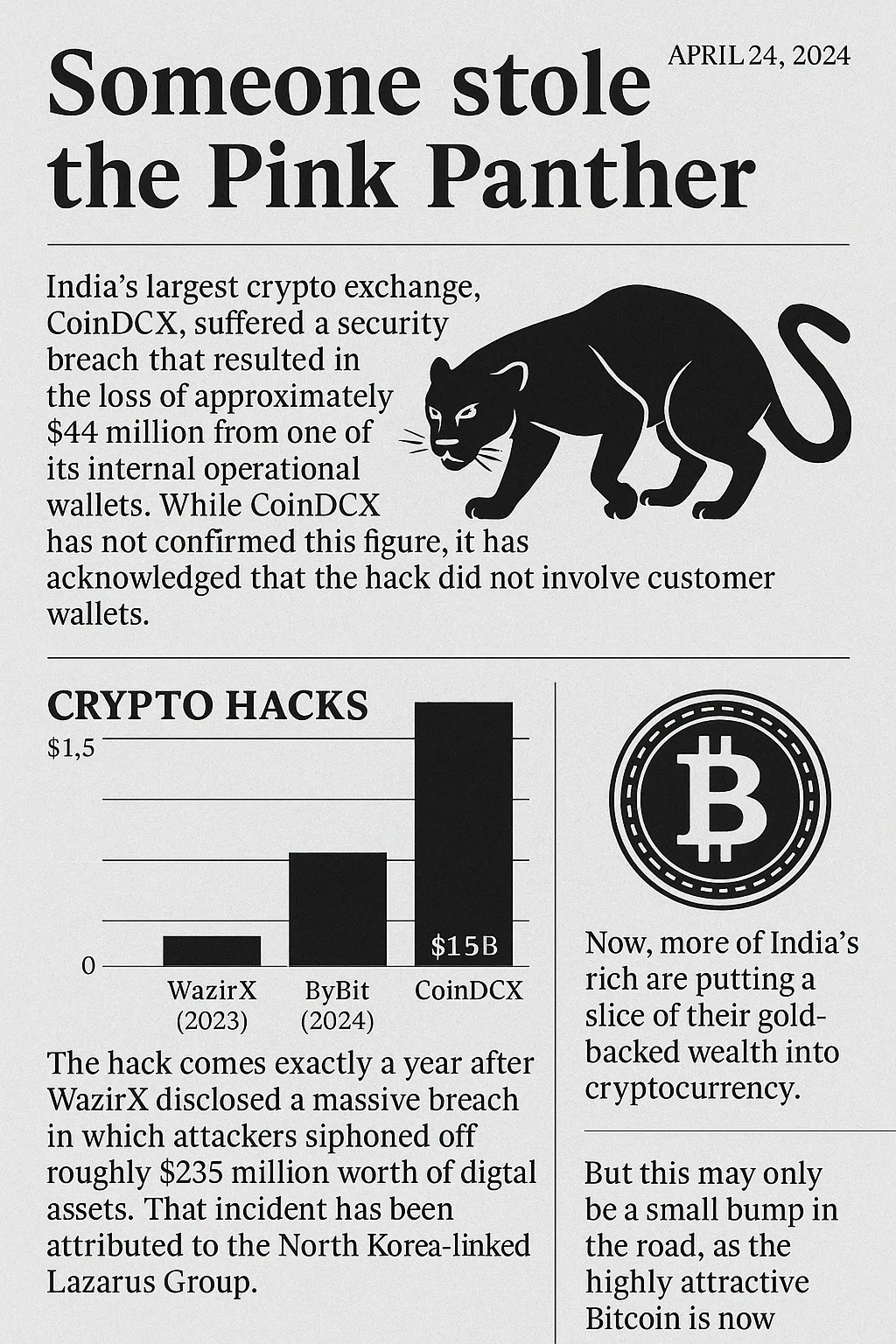

The incident comes almost exactly a year after rival exchange WazirX suffered a historic breach, losing an estimated $235 million. That hack was attributed to the notorious Lazarus Group, North Korea’s state-backed cybercrime syndicate, which has been linked to a series of attacks exploiting operational lapses at crypto firms.

Earlier this year, the same group was behind the $1.5 billion ByBit hack, the largest single theft in crypto history. Security experts fear that Lazarus operatives are using increasingly sophisticated methods to infiltrate exchanges through compromised IT staff, a tactic highlighted in a recent United Nations report.

A Market That Refuses to Blink

Despite the headlines, India’s crypto scene remains vibrant. The hack, which CoinDCX says affected only internal operational wallets, appears to have done little to dent market enthusiasm. Trading volumes on rival platforms ticked higher in the hours after the news broke, with Bitcoin climbing above $118,000 as global risk appetite improved.

“Operational breaches are serious, but customers should note that the incident did not involve user wallets,” said Rohan Kulkarni, an independent security analyst based in Mumbai. “The real concern is how these groups continue to find gaps in backend systems."

High Net Worth Indians Move In

Far from retreating, India’s wealthy elite are edging deeper into digital assets. According to figures from Mudrex, roughly 30% of its trading volumes now come from high-net-worth individuals (HNIs). Many are allocating 2-5% of their gold-backed wealth into cryptocurrencies as a hedge against inflation and as a play on the global adoption of blockchain technology.

Analysts say this quiet flow of money is helping stabilise India’s exchanges even as operational risks grab headlines. “For HNIs, a $44m hack is a footnote in a market moving hundreds of billions,” said Devika Mehra, chief economist at a Delhi fintech consultancy. “The long-term narrative remains strong: digital assets are here to stay.”

Lessons Still Unlearnt?

Critics contend that in the absence of robust internal controls, exchanges expose themselves to a recurrence of past events. Calls are growing for regulators in New Delhi to mandate independent audits of operational wallets and real-time breach reporting.

For now, the Pink Panther saga serves as both a warning and a testament to the resilience of India’s crypto industry. A year after Lazarus hit WazirX and months after ByBit’s record-breaking loss, India’s exchanges are still standing – and, in many cases, still growing.

Stay on top of any cryptocurrency news by following us on X @ouinex